In the News

City of Springfield to Adjust Deadline for Tax Relief Applications

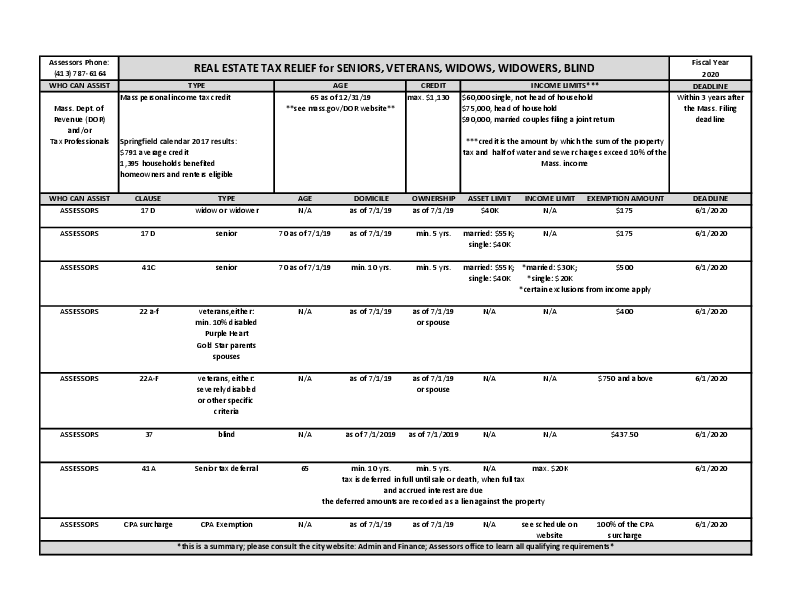

Mayor Domenic J. Sarno has announced that following Governor Baker signing a Municipal Relief legislation (H4598: An Act to Address Challenges Faced by Municipalities and State Authorities Resulting from COVID-19), the City of Springfield will adjust the deadline for filing personal exemption and deferral applications to June 1, 2020. The original statutory deadline was April 1, 2020.

The due date for filing personal exemption and deferral applications is a state statute and any changes required approval by the state Legislature and the Governor.

Mayor Sarno stated, “During these challenging and extraordinary times, my administration is committed to trying to provide any relief and assistance possible to our taxpayers while following local and state legal statutes to maintain our city services and operations. I am thankful to our local state delegation and to Governor Baker for working together to provide this much needed relief to our tax paying residents and businesses.”

Assessor Richie Allen added, “The Springfield Board of Assessors has recommended to the Mayor that this state statutory deadline be extended to June 1. The City’s Assessors Office has already approved approximately 1,100 exemptions for elderly, widows(ers), veterans, and blind persons. It is our hope that by having this extended deadline for personal exemptions and deferral applications additional eligible households might apply and possibly receive some relief.”

Previously, the City of Springfield had adjusted the collection dates for 4th quarter real estate and personal property taxes to June 1, 2020. The original due date was May 1, 2020.

The City of Springfield Assessor’s Office also encourages homeowners, renters and residents 65 years or older to consider applying for the Circuit Breaker Tax Credit as well.

For more information and applications on these statutory abatement exemptions, please visit the city’s Board of Assessors website at www.springfield-ma.gov/finance/assessors or call the Assessor’s Office at (413) 787-6164. Residents can also contact our city’s 311 Call Center at (413) 736-3111.

Please see the attached FY20 Personal Exemption Chart.