Employee Self Service Overview

Employee Self Service (ESS) is the Munis Self Service application created specifically for current employees. For employees, ESS provides access to personal information, pay and tax information and certifications. When you update information through employee self-service, the updates occur simultaneously in the live system.

Employee Self Service Users

The Employee Self Service application requires users to have a unique username and password. For first time users, the username will be your employee identification number. This number is located on your check stub or direct deposit advice. The initial password will be the last four digits of your social security number. You will be prompted to change your password upon initial login.

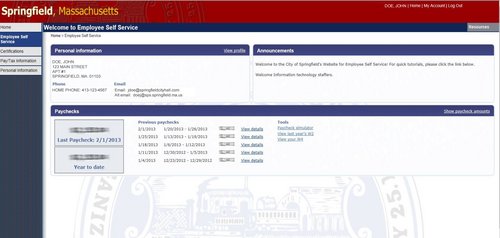

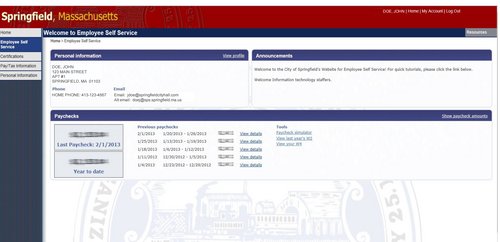

ESS Main Page

Paychecks

The Paychecks panel displays information for the most recent pay periods where you received pay. You can view the Paycheck Simulator, Year-to-Date Information, or W-4 Information.

The blurred image represents your year-to-date earnings. It displays initially as blurred for security purposes. Click Show Paycheck Amounts to convert the image to the dollar amount; click Hide Paycheck Amounts to return to the blurred image.

Announcements

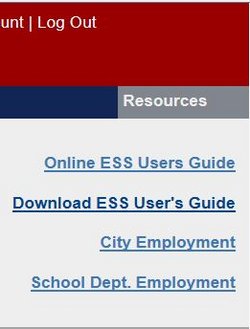

Resources

The Resources option in the upper-right corner of the screen displays employee resources that are available. This allows quick and easy access to the City of Springfield and the Springfield Public Schools employment opportunities pages. Additionally, interactive tutorials and manuals are available in this section for easy access.

ESS Menu Options

Certifications

Certifications display a list of your certifications. This list includes the certification type, area, level, number, and effective and expiration dates. Please note that if your license is not currently in use an expiration date is not assigned. Therefore, the system automatically assigns the expiration date of 1/1/0001.

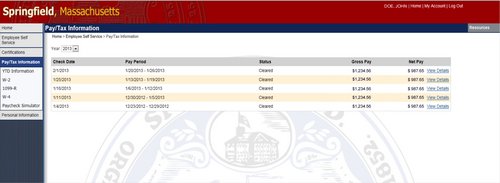

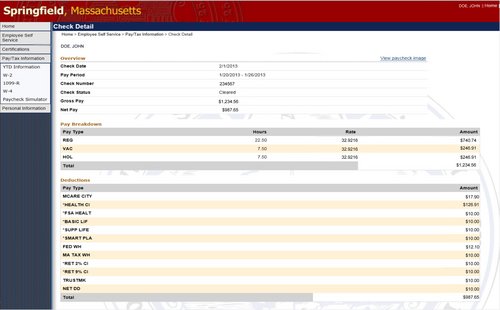

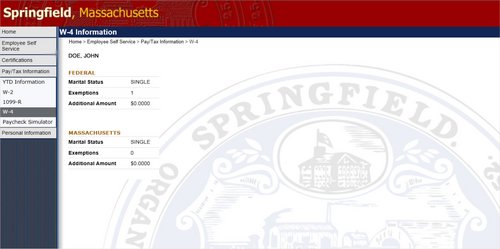

Pay/Tax Information

Pay/Tax Information provides current payroll and payroll history details. You cannot modify pay or tax information; it is display only.

Pay/Tax Information displays a list of payment history records for the year. The default year is the current year, but you can also view past years. Click “View Details” to view more information for a specific pay period/paycheck.

YTD Information

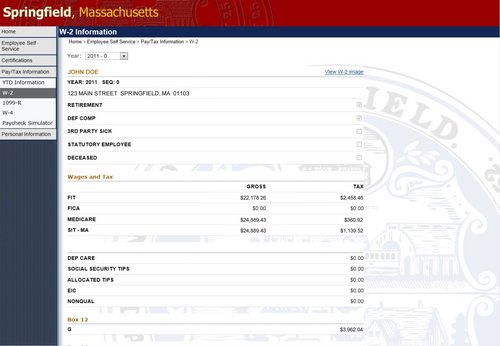

View Last Year’s W2

W-2 Information provides wage and deduction details for a selected year.

From the main page, select the year to view from the Year list; the program displays the details.

To access an image of your W2, click the blue text “View W-2 image”. This displays the actual

W2 so you can print extra copies as needed.

W2 Details

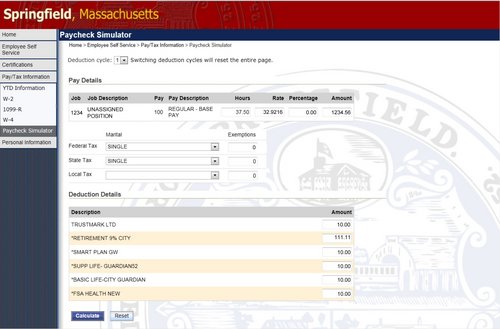

Paycheck Simulator

The Pay Check Simulator allows you to simulate adjustments to your pay, tax, or deductions in order to see how the changes would affect your total pay. The program does not permanently alter your pay records and should only be used as an estimate. Your retirement deductions may vary.

To use the simulator:

1. Enter the pay, tax, or deduction changes.

Personal Information

You can make changes to your mailing address. You can also maintain your telephone numbers and emergency contacts.

Employee Profile

The Employee Profile page displays general and demographic information, such as hire date and date of birth, as well as race and ethnicity information. This page also contains an option for contacting Payroll Department. You cannot modify this information. If you have changes, please use the “Contact” feature located at the bottom of the page to notify Payroll.