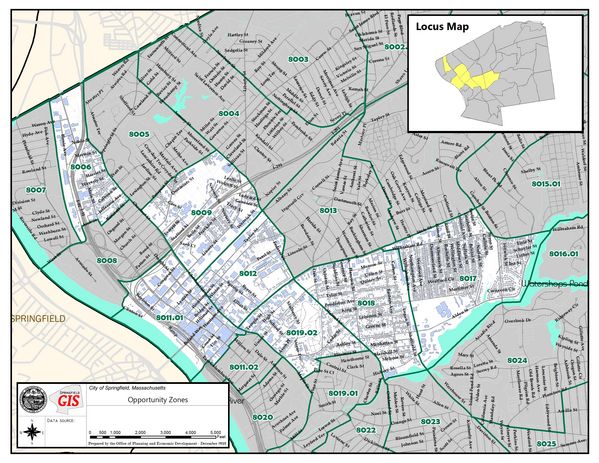

Opportunity Zones

Opportunity Zone Program

The recently passed U.S. Tax Cut and Jobs Act of 2017 created the Opportunity Zone Program to provide incentives for investment in low income communities throughout the country. An Opportunity Zone is a designated geographic area, in which individuals can gain favorable tax treatment on their capital gains, by investing those funds (through a privately-created Opportunity Fund) into economic activities in the area. The Governor of each state is able to nominate up to 25 percent of its low income census tracts (LICs) to be designated as Opportunity Zones.

An Opportunity Zone is a community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as Opportunity Zones if they have been nominated for that designation by the state and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation authority to the Internal Revenue Service.

The Opportunity Zone program provides a tax incentive for investors to re-invest unrealized capital gains into Opportunity Funds dedicated to investing into designated Opportunity Zones.

For additional Information please see link below:

https://www.mass.gov/opportunity-zone-program