Office of Housing

Request for Proposals - Emergency Solutions Grant Program

The City of Springfield has released its Request for Proposals (RFP) for the Emergency Solutions Grant (ESG) Program for the program year July 1, 2024 to June 30, 2025.

The ESG program funds non-profit agencies to operate programs providing homelessness prevention, street outreach, emergency shelter, and rapid rehousing. Applications must be submitted by 4 pm on March 8, 2024.

The RFP is available at https://www.cognitoforms.com/CityOfSpringfield1/EmergencySolutionsGrantFY24

The City will hold an optional question-and-answer session on this grant opportunity on February 23, 2024 at 10 am, via Zoom, accessed through this link

NEW March 1, 2024! See the Q&A from the Feb. 26 Bidders' Conference.

Continuum of Care Application and Project Priority Listing

The Springfield-Hampden County Continuum of Care has completed preparation of its application for the FY23 competition, and the application materials have been approved by the CoC Board of Directors. The materials are available for review at the links below:

The application will be submitted to the US Department of Housing and Urban Development on September 28, 2023.

Comments about the application and project priority listing may be submitted to gmccafferty@springfieldcityhall.com.

City of Springfield Announces Tax Title Auction of 21 Properties (CANCELLED)

IMPORTANT NOTICE: THE CITY AUCTION SCHEDULED FOR 10/24/2023 HAS BEEN CANCELLED. PLEASE CHECK BACK SOON FOR UPDATED AUCTION INFORMATION.

if you have questions, please contact Vanessa Adorno in the Office of Housing at vadorno@springfieldcityhall.com or by phone at 886-5197.

AUCTION WORKSHOP INFORMATION - See below for Auction Workshop Information

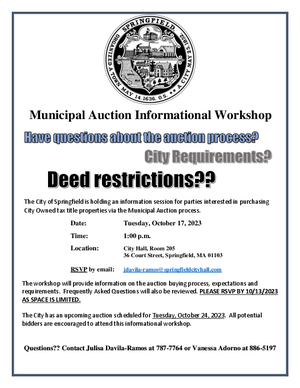

Municipal Auction Informational Workshop

If you didn't have an opportunity to attend our Municipal Auction Workshop on October 17th 2023, please check out the link below to view the Workshop PowerPoint: Municipal Auction Workshop PowerPoint

City Announces Municipal Auction Informational Workshop

AUCTION WORKSHOP INFORMATION - Have questions about the auction? City requirements? Deed Restrictions??

UPDATE - THE WORKSHOP IS BOOKED! IF YOU WERE UNABLE TO RSVP FOR THE EVENT, PLEASE CHECK BACK ON THIS PAGE AFTER 10/17/2023. WE WILL BE POSTING THE UPDATE POWERPOINT WORKSHOP.

The City of Springfield will be holding an Auction Workshop on Tuesday, October 17th, 2023 at 1:00 p.m. The workshop will be held at City Hall, Room 205 located at 36 Court Street.

Download flyer here! If interested in attending, please fill out the RSVP auction workshop form and return to Julisa Davila-Ramos in the Office of the Treasurer via email at Jdavila-ramos@springfieldcityhall.com by Friday, October 13th to reserve a spot as space is limited.

Funding Opportunity: Hampden County CoC seeks Provider to Operate Transitional Housing Program

The Springfield-Hampden County Continuum of Care (CoC) seeks a nonprofit organization to operate an existing scattered-site transitional housing program for 18 homeless households.

A CoC subrecipient that has operated a scattered site transitional housing (TH) program using CoC funds has declined to accept its most recent CoC grant because the program is now fully funded by the state of Massachusetts. The CoC seeks a new subrecipient to operate the CoC program. The CoC-funded program that has relinquished the grant served survivors of domestic violence, but the grant is not restricted to serving that population.

For any projects that will serve households with youth (18-24) heads of household, the CoC can also make available supportive services funds to be used in conjunction with the CoC grant. This RFP opportunity allows applicants to apply for both sources of funds in this single application, as long as the proposed project will serve the target youth population. Applicants may also apply only for the HUD CoC funds, to serve a different population.

Please see the Request for Proposal for more information: Transitional Housing Program Provider (cognitoforms.com)

Springfield-Hampden County Continuum of Care Releases RFP Seeking Programs to Provide Housing to People Experiencing Homelessness

The Springfield-Hampden County Continuum of Care has released a Request for Proposals (RFP) for its FY23 CoC Competition.

The competition is for renewal, expansion and new projects that provide permanent supportive housing (PSH), rapid rehousing (RRH), transitional housing (TH), a combination of transitional housing and rapid rehousing (TH-RRH), ans supportive service only (SSO). There is a bonus amount of funds available only for projects that serve victims of domestic violence, dating violence, sexual assault, and stalking.

There are two parts to the required submission. Part 1 is an application in HUD’s esnaps system. Part 2 is the local application.

Applications are due by 5 pm on August 29, 2023.

A bidder's conference will be held August 17, 2023 at 11 am--see the RFP for a Zoom link to the session.

City Announces Qualified Homebuyer Lottery Opportunity

The City of Springfield has partnered with the North End Housing Initiative and C&C Homes to provide funding for new construction of four new single family homes at the following locations in the Maple-High/Six Corners neighborhood:

- 251 Central Street

- 402 Central Street

- 414 Central Street

- 271 Pine Street

Each newly constructed home will have three (3) bedrooms and two and a half (2 ½) bathrooms. 414 Central Street and 251 Central Street will have garages. Each home will be sold for approximately $190,000. In today's real estate market, this presents an incredible economic opportunity for a family to purchase a home with significant equity from the start. Because of this, the City of Springfield has decided to choose the ultimate purchasers through a lottery system. It is anticipated that construction and sales will be completed by late Autumn 2023. In order to be eligible for the homebuyer selection lottery, buyers must meet the following qualifications:

1. All applicants must be first-time homebuyers

2. All applicants must have a household income less than 80% Area Median Income

2. All applicants must be be pre-approved for a mortgage from a traditional lender in an amount equal or greater than $190,000 and be able to provide proof of pre-approval.

3. All applicants must be a current Springfield resident and be able to provide proof of residence.

4. Provide documentation that applicant has completed Homebuyer Counseling from a HUD-Certified Housing Counselor that is employed by a HUD Certified housing counseling agency, or is enrolled to participate in a program prior to closing.

5. Final purchaser will need to agree to live in the house for a period of not less than fifteen (15) years.

APPLICATIONS ARE DUE TO THE OFFICE OF HOUSING BY 4:30 PM ON AUGUST 25, 2023. You may submit an application two ways:

1. Electronically using this link: https://www.cognitoforms.com/CityOfSpringfield1/CITYOFSPRINGFIELDHOMEBUYERLOTTERYAPPLICATION2 OR In person to the City of Springfield, Office of Housing, 1600 East Columbus Avenue, Springfield, MA 01103

Questions regarding this opportunity should be directed to Jocelyn Rivera-Jimenez in the Office of Housing at 413-787-6500 or JRiveraJimenez@springfieldcityhall.com

Interested purchasers may click here for more information regarding this opportunity

Funding Opportunities - Two RFPs released Feb. 1, 2023

Emergency Solutions Grant (ESG)

The City of Springfield is seeking organizations to provide ESG-funded programs serving people living in Springfield. The ESG program provides funds to non-profit agencies to operate programs providing homelessness prevention, street outreach, emergency shelter, and rapid rehousing.

Click for details about the ESG RFP and the online application. Applications are due by noon on March 2, 2023.

Housing Opportunities for Persons with AIDS (HOPWA)

The City of Springfield is the recipient of federal HOPWA funds for the Eligible Metropolitan Statistical Area (EMSA) of Hampden, Hampshire and Franklin Counties, MA, and is seeking organizations to operate HOPWA programming throughout the EMSA. The HOPWA program provides funds to non-profit agencies to provide housing assistance and related supportive services for low-income people living with HIV (PLWH) and their families.

Click for details about the HOPWA RFP and the online application. Applications are due by noon on March 2, 2023.

City seeks Nonprofit Developers to Build Infill Homeownership Units in Old Hill

The City of Springfield seeks nonprofit housing development organizations to partner with the City in an application for grant funds to develop infill homes in the Old Hill neighborhood, with completed homes to be sold to income-qualified first-time homebuyers. For more information and to apply, go to: https://www.cognitoforms.com/CityOfSpringfield1/RFPNonprofitDevelopmentOfInfillHomes

Applications are due to the City by noon January 4, 2023.

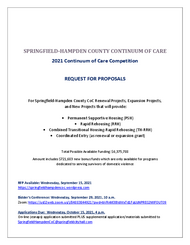

Continuum of Care FY22 Consolidated Application

The Springfield-Hampden County Continuum of Care (CoC) has posted its FY22 Consolidated Application, which will be submitted to the US Department of Housing and Urban Development (HUD).

The CoC posted a Request for Proposals for this local competition on August 10, 2022. The local competition selected the projects to be included in this annual request for funding to HUD.

There are two parts to the application--click on each title to access the document.

- The CoC Consolidated Application describes the CoC's work over the last year and planned work for the upcoming year

- The Project Priority List details the projects that the CoC has submitted to HUD for funding

HOME-ARP Allocation Plan

The City has released its HOME-ARP Allocation Plan, which has been submitted to the US Department of Housing and Urban Development for approval. This Plan describes the City's plan for use of approximately $6 million of federal HOME-ARP funds.

The City will issue Requests for Proposals seeking organizations to carry out HOME-ARP activities in the next several weeks.

Springfield-Hampden County CoC Releases 2nd SPECIAL RFP Seeking Projects that Respond to Unsheltered Homelessness

The Springfield-Hampden County Continuum of Care has released a second SPECIAL Request for Proposals (RFP) seeking outreach and housing programs that respond to unsheltered homelessness. This opportunity will provide three-year grants that may be renewed annually after the initial grant term.

Applications are due by 5 pm on September 20, 2022.

An information session for this opportunity will take place September 1, 2022 at 3 pm, and a bidder's conference will take place September 12, 2022 at 3 pm. See the RFP for Zoom links to these sessions.

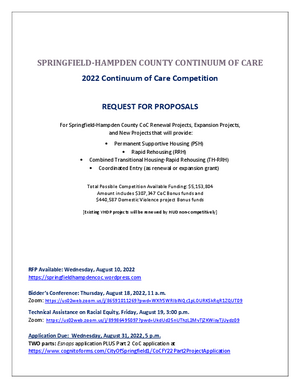

Springfield-Hampden County Continuum of Care Releases RFP Seeking Programs to Provide Housing to People Experiencing Homelessness

The Springfield-Hampden County Continuum of Care has released a Request for Proposals (RFP) for its FY22 CoC Competition.

The competition is for renewal, expansion and new projects that provide permanent supportive housing (PSH), rapid rehousing (RRH) or a combination of transitional housing and rapid rehousing (TH-RRH). Proojects that will provide coordinated entry may also apply. There is a bonus amount of funds available only for projects that serve victims of domestic violence, dating violence, sexual assault, and stalking.

There are two parts to the required submission. Part 1 is an application in HUD’s esnaps system. HUD has not yet opened the esnaps portal. Applicants will be notified as soon as it is open. Part 2 is the local application.

Applications are due by 5 pm on August 31, 2022.

A bidder's conference will be held August 18, 2022 at 11 am, and a Technical Assistance Session on Racial Equity will be held August 19, 2022 at 3 pm. See the RFP for Zoom links to these sessions.

ARPA Housing Program Application Status Update

On May 27, 2022 the City of Springfield announced $5,000,000 in ARPA funding for the Exterior Repair Program and the Healthy Homes Program. Since that time, the volume of applications received for both programs has been high. In order for the Offices of Housing and Disaster Recovery to effectively process the applications filed to date with the available funding, both programs have stopped accepting new applications. If you have submitted a complete application for the Exterior Repair/Healthy Homes Program, your application is being reviewed. Once the application review is completed you will be contacted regarding your application status. Applications are processed on a first-come, first-serve basis based on the date of submission. If either of these programs re-open for new applications, that information will be posted on this website.

Questions may be directed to Maricely Vega at mvega@springfieldcityhall.com or 413-787-6500.

Draft HOME-ARP Allocation Plan Available for Public Comment

The Office of Housing has released Springfield’s DRAFT HOME-ARP Allocation Plan for public comment. The plan indicates how the City expects to spend its $6 million allocation of federal HOME-ARP funds.

The plan is available for public comment until September 2, 2022 at 4 pm.

Comments on the plan may be provided in writing to gmccafferty@springfieldcityhall.com or mailed or delivered to the Office of Housing, 1600 E. Columbus Ave., Springfield, MA 01103.

Comments may also be made during public hearings on the plan. The hearings will take place:

- Tuesday, August 16, 2022, 5 pm, on Zoom [Register at https://forms.gle/EVZ3ChpywNntcQYd6 to receive a link for the Zoom meeting]

- Wednesday, August 17, 2022, 2 pm, on the City’s Facebook page

HOME-ARP funds have been made available by the U.S. Department of Housing and Urban Development (HUD) to the City to meet housing and service needs of four qualifying populations: homeless, at risk of homelessness, survivors of domestic violence/trafficking, and other populations with greatest risk of housing instability. This is a one-time allocation of funds and must be spent by September 30, 2030.

Borrador del Plan de Asignación HOME-ARP disponible para comentarios públicos

La Oficina de Vivienda ha publicado el BORRADOR del Plan de Asignación HOME-ARP de Springfield para comentarios públicos. El plan indica cómo la Ciudad espera gastar su asignación de $6 millones de fondos federales HOME-ARP.

El plan está disponible para comentarios públicos hasta el 2 de septiembre del 2022 a las 4 pm.

Los comentarios sobre el plan pueden proporcionarse por escrito a gmccafferty@springfieldcityhall.com o enviarse por correo o entregarse a la Oficina de Vivienda, 1600 E. Columbus Ave., Springfield, MA 01103.

También se pueden hacer comentarios durante las audiencias públicas sobre el plan. Las audiencias se llevarán a cabo:

· Martes 16 de agosto del 2022, 5 pm, en Zoom

· Miércoles 17 de agosto del 2022, 2 pm, en la página de Facebook de la Ciudad

Los fondos home-ARP han sido puestos a disposición por el Departamento de Vivienda y Desarrollo Urbano de los Estados Unidos (HUD) a la Ciudad para satisfacer las necesidades de vivienda y servicios de cuatro poblaciones calificadas: personas sin hogar, en riesgo de quedarse sin hogar, sobrevivientes de violencia doméstica / trata y otras poblaciones con mayor riesgo de inestabilidad de vivienda. Esta es una asignación única de fondos y debe gastarse antes del 30 de septiembre del 2030.

Si desea obtener más información, llame a Maricely Vega en la Oficina de Vivienda de la Ciudad de Springfield al 413-787-6500.

City Seeks Proposals for the Purchase and Redevelopment of 471 Plainfield Street

The City of Springfield (City) is requesting proposals for the purchase and redevelopment of 471 Plainfield Street, formerly Brightwood Elementary School.

Proposals must be submitted by 2 pm August 31, 2022 to the Office of Procurement, City Hall, 36 Court Street Room 307. Click here to obtain additional information regarding this opportunity.

Brightwood Elementary School moved to a new site in August 2021, and this site has been vacant since that time. The local community has identified a neighborhood need for affordable housing for seniors and supports redevelopment of the site for that purpose.

The historic 54,198 square feet brick building was built in 1989, It has three levels (basement and two floors), and is situated on a 76,429 square foot lot. The assessed value of the property is $7,003,500.

Questions regarding this solicition should be submitted in writing no later than August 12, 2022 to kvegh@springfieldcityhall.com and gmccafferty@springfieldcityhall.com.

City Seeks Proposal for the Purchase and Redevelopment of 241 Main Street, Indian Orchard

The City of Springfield has issued a Request for Proposals (RFP) for the purchase and redevelopment of the tax foreclosed property at 241 Main Street, Indian Orchard.

Proposals must be submitted by August 15, 2022 at 2pm to the Office of Procurement, City Hall, 36 Court Street Room 307. Click here to obtain additional information regarding this opportunity.

The building at 241 Main Street is a mixed-use building constructed circa 1907, it contains approximately 8,200 square feet of gross living/commercial space and is located on a 7,904 square foot lot and is zoned Business A. The property has three floors and contains approximately two commercial units on the ground floor and four residential units on the 2nd and 3rd floors. The assessed value is $301,600.00. The City is seeking minimum bids of $1,000.00. The minimum bid was set taking into consideration the extensive renovation work necessary to rehabilitate the property.

Questions regarding this solicition should be submitted in writing to kvegh@springfieldcityhall.com and tquagliato@springfieldcityhall.com

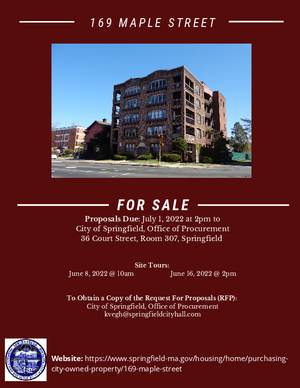

City Seeks Proposals for the Purchase and Redevelopment of 169 Maple Street

The City of Springfield has issued a Request for Proposals (RFP) for the purchase and redevelopment of the tax foreclosed property at 169 Maple Street.

Proposals must be submitted by July 1, 2022 at 2pm to the Office of Procurement, City Hall, 36 Court Street Room 307. Click here to obtain additional information regarding this opportunity.

169 Maple Street is part of the Ridgewood Historic District, listed on the National Register of Historic Places. The property is zoned Commercial A, is currently vacant and contains approximately ten, spacious, three-bedroom units. The building was constructed in 1920 and is approximately 30,552 square feet, sited on a 7,454 square foot lot. The assessed value of the property is $150,000.

The City is also making available the vacant lot at SS Central Street (02560-0220), that developers may consider incorporating into their development plans as designated parking for the property. The City is not requiring development of this vacant lot as a condition of sale, but is requiring that developers develop a feasible parking plan as part of redevelopment of the property.

Questions regarding this solicition should be submitted in writing no later than June 24, 2022 to kvegh@springfieldcityhall.com and tquagliato@springfieldcityhall.com

City of Springfield Announces New ARPA Funded Housing Repair Programs

The City of Springfield has announced two new housing rehabilitation programs, funded by the American Rescue Plan Act (ARPA).

Healthy Homes Program

The Healthy Homes Program provides funding for homeowners to rehabilitate their homes and address health issues in housing, including lead paint and asthma triggers. The program is for residential properties with 1-4 units, and is available for income-eligible households in Qualified Census Tracts.

A full program description and eligibiltiy requirements can be viewed at the Healthy Homes Program Fact Sheet.

The application is online at Healthy Homes Program Application

Exterior Home Repair Program

The Exterior Home Repair Program provides homeowners with up to $40,000 to fund exterior home repairs, including roofs, windows, porches, siding, and painting for residences with 1-4 units. The program is available for income-eligible households citywide.

A full program description, including eligibility requirements and income limits, is available in the Exterior Home Repair Program Fact Sheet.

The application is online at Exterior Home Repair Application.

Q & A on the Infill Homeownership Development Opportunity

Q & A on the Infill Homeownership Development Opportunity - There have been several questions about the RFP the City released on March 23, 2022 for a partner to develop infill homeownership housing in the Old Hill neighborhood.

Please click on link for responses: Nonprofit Development of Infill Homes Q & A

Remember that responses are due by noon this Thursday, April 7, 2022

City of Springfield Development Partnership Opportunity - Infill Homeownership

The City of Springfield is seeking a nonprofit housing development organization to partner with the City in an application for MassHousing Neighborhood Stabilization Program (NSP) funds to develop infill single-family homes on City-owned land in the Old Hill neighborhood, with completed homes to be sold to income-qualified homebuyers. The City intends to provide additional funding for this project, using either HOME Partnerships Investment Program or American Rescue Plan Act funds. The goal for the project is to develop 11 new homes, with subsidy funding of $2.75 to $3.3 million.

The City has released a Request for Proposal in order to identify and evaluate interested organizations. The RFP is available here:

https://www.cognitoforms.com/CityOfSpringfield1/RequestForProposalsNonprofitDevelopmentOfInfillHomes

Applications are due by noon April 7, 2022. The selected organization must commit to work with the City to complete the NSP application to MassHousing by its due date of April 14, 2022.

Continuum of Care – Funding Opportunities for Nonprofits

The Springfield-Hampden County Continuum of Care (operated by the City of Springfield Office of Housing) has released notice of two funding opportunities today. Deadline for both applications is noon March 11, 2022.

Permanent Supportive Housing

The Springfield-Hampden County Continuum of Care seeks a nonprofit organization to operate an existing scattered-site permanent supportive housing program for 32 chronically homeless individuals.

For more information and to apply: https://www.cognitoforms.com/CityOfSpringfield1/PermanentSupportiveHousingProvider

Housing for Homeless Young Adults

The Springfield-Hampden County Continuum of Care is making up to $450,000 in capital funds available for a nonprofit organization to create affordable housing units in Hampden County for homeless young adults aged 18-24.

For more information and to apply:

https://www.cognitoforms.com/CityOfSpringfield1/FundingAvailabilityHousingForHomelessYoungAdults

Request for Proposals – Emergency Solutions Grant (ESG) Program

The City of Springfield Office of Housing has issued a Request for Proposals (RFP) seeking applications from nonprofit organizations to provide services for people experiencing homelessness. The program funds projects that provide: 1) Street Outreach; 2) Emergency Shelter; 3) Homelessness Prevention; and 4) Rapid Rehousing.

The RFP and application is available at https://www.cognitoforms.com/CityOfSpringfield1/EmergencySolutionsGrant

The deadline for proposal submission is no later than noon on March 8, 2022.

City of Springfield Seeks Resident Input in the Re-Use of former MCDI Site

The City of Springfield has completed the demolition of the former MCDI site at 140 Wilbraham Avenue and is asking residents to complete this survey regarding re-use of the property: https://www.surveymonkey.com/r/LJNZKJH The City is particularly seeking responses from residents of the Old Hill and Upper Hill neighborhoods.

The Massachusetts Career Development Institute closed in 2013 and the property was abandoned by the owner. In 2016, a devastating arson related fire occurred at the property. The fire was so intense it took over 40 hours to extinguish and damaged more than half of the building. The property was foreclosed by the City for the non-payment of taxes in 2019 and as the City was soliciting proposals for redevelopment of the non-damaged portion of the building, the property was the target of multiple arson fires, forcing complete demolition of the building. The demolition was completed in multiple phases. The first phase was completed by Vinagro Corp., out of Rhode Island and the second phase was completed by Associated Building Wreckers of Springfield at a total cost of $2,554,587.

Click here to view Mayor Sarno's full press release

City Announces Lottery for Home Ownership Opportunity

These homes were developed by a partnership of the City of Springfield and the North End Housing Initiative, Inc. (and their consultant NAI Plotkin). They are funded largely by the HUD/City's HOME Program (Home Investment Partnerships Program).

These 3 BR homes, which cost approximately $300,000 each to build, are state of the art construction and built to the stretch energy code. Because the goal of the HOME Program is to produce affordable, sustainable housing, the homes will each be sold for approximately $200,000 (we are awaiting final numbers and appraisal).

In today's red-hot real estate market, this presents an incredible opportunity for an income-eligible family to purchase with a significant amount of equity from Day One. Because of this, we have decided to choose the ultimate purchasers through a lottery system. Potential applicants must have a household income <80% Area Median Income and be pre-approved for a mortgage to cover purchase price. APPLICATIONS WILL BE DUE IN OUR OFFICE BY 4:30 PM ON NOVEMBER 8, 2021. This will give renters who weren't already in the market for a home enough time to become pre-approved by a mortgage lender. A link to the application is below:

https://www.cognitoforms.com/CityOfSpringfield1/CITYOFSPRINGFIELDHOMEBUYERLOTTERYAPPLICATION

Click here for additional information and photos of each home

Springfield Hampden Continuum of Care – Request for Proposals

The Springfield-Hampden County Continuum of Care has released a Request for Proposals (RFP) for renewal, expansion and new projects. Allowable project types for this competition are: Permanent Supportive Housing (PSH), Rapid Rehousing (RRH), Joint Transitional Housing-Rapid Rehousing (TH-RRH) and Coordinated Entry (CE).

Proposals are due at 4:00 pm October 15, 2021. Contact SpringfieldHampdenCoC@springfieldcityhall.com for more information.

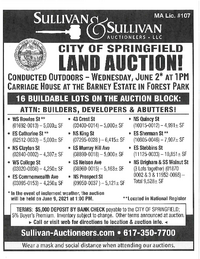

City of Springfield Announces Tax Title Auction of 16 Buildable Lots & Auction Workshop

AUCTION INFORMATION - The City of Springfield will be holding its first real estate auction of 2021!

Date/Time: Wednesday, June 2nd, 2021 at 1:00 p.m.

Location: The auction will be held outdoors at the Carriage House at the Barney Estate located in Forest Park, Springfield. Registration will begin promptly at 12:00 p.m. Download the auction flyer here!

Please visit Carriage House at the Barney Estate in Forest Park, SPRINGFIELD, MA | Sullivan & Sullivan Auctioneers (sullivan-auctioneers.com) for more information.

- Click here to view the Terms & Conditions of Sale

- Click here to view the Custodian's Notice of Sale

- Click here to view a Sample Memorandum of Sale

Please use the City's GIS map research tool to locate the parcels that will be available at the auction.

AUCTION WORKSHOP INFORMATION - See below for Auction Workshop Information

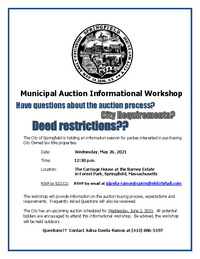

City Announces Municipal Auction Informational Workshop

AUCTION WORKSHOP INFORMATION - Have questions about the auction? City requirements? Deed Restrictions??

The City of Springfield will be holding its first Auction Workshop on Wednesday, May 26th, 2021 at 12:30 p.m. The workshop will be held outdoors at the Carriage House at the Barney Estate located in Forest Park in Springfield. Please contact Julisa Davila-Ramos at the Office of Housing at Jdavila-ramos@springfieldcityhall.com by Friday, May 21, 2021 to reserve a spot as space is limited. Download flyer here.

Not able to make it? Click on the link or thumbnail below for access to the Municipal Auction Information Workshop Powerpoint.

Request for Proposals: Emergency Solutions Grant-Coronavirus (ESG-CV) Funds

The City of Springfield’s Office of Housing has issued a Request for Proposals (RFP) seeking one or more applicants to provide services for homeless individuals. The seeks to fund projects that provide: 1) Street Outreach; 2) New Low-Barrier Non-Congregate Emergency Shelter; 3) Prevention/Diversion for individuals seeking emergency shelter; and 4) Rapid Rehousing.

The RFP is available by request by sending an email to gmccafferty@springfieldcityhall.com.

The deadline for proposal submission is no later than noon, Friday, September 11, 2020.

Springfield-Hampden County Continuum of Care - Request for Proposals

The Springfield-Hampden County Continuum of Care (CoC) has issued a Request for Proposals seeking one or more applicants to provide medium-term (up to 2 years) rapid rehousing for homeless youth and young adults (YYAs). The RFP seeks one or more agencies to provide a total of 30 units of rapid rehousing, to be staffed with a total of four case managers. The grant is for an initial two-year term and has a budget of $1,061,159; it will be renewable on an annual basis after the initial term.

The CoC has spent the last year creating a coordinated community plan to prevent and end YYA homelessness. This project will be one of four new coordinated programs created through the Youth Homelessness Demonstration Project (YHDP). The other programs are:

- Coordinated Entry and Navigation Project – CHD Safety Zone and Gandara Center

- Transitional Housing-Rapid Rehousing (11 units) – Gandara Center

- Permanent Supportive Housing (8 units) – Mental Health Association

Proposals are due July 7, 2020 by 4 pm. Please contact Gerry McCafferty at gmccafferty@springfieldcityhall.com for more information.

Released for Public Comment: Analysis of Impediments to Fair Housing Choice

The City of Springfield joined with the cities of Chicopee, Holyoke and Westfield to undertake an analysis of impediments to fair housing choice. This document identifies fair housing issues, sets goals to address the issues and lists strategies the cities will take to achieve those goals. The draft document is available for public comment until May 27, 2020. Click here or on the DRAFT Analysis of Impediments to Fair Housing Choice document to the left to view

Please submit comments by email to gmccafferty@springfieldcityhall.com, or in writing by mailing to the Office of Housing, 1600 E. Columbus Ave., Springfield, MA 01103.

IMPORTANT NOTICE - Municipal Auction & Auction Workshop

To All Interested Parties:

Due to the evolving concerns related to the spread of COVID-19 – Coronavirus and out of an abundance of caution, the City of Springfield has announced that it will be canceling the Municipal Auction scheduled to be held at City Hall on April 14, 2020 as well as the Auction Workshop scheduled for April 6, 2020 at UMass Center

The City will announce a rescheduled date at a later time.

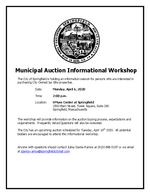

City Announces Municipal Auction Information Workshop

The City of Springfield is holding an information session for persons who are interested in purchasing City Owned tax title properties. The workshop will take place on Monday, April 6, 2020 at 2:00pm at UMass Center at Springfield, 1500 Main Street. Please see attached flyer.

The workshop will provide information on the auction buying process, expectations and requirements. Frequently Asked Questions will also be reviewed. The City has an upcoming auction scheduled for Tuesday, April 14th 2020. All potential bidders are encouraged to attend this informational workshop.

Anyone with questions should contact Julisa Davila-Ramos at (413) 886-5197 or via email at jdavila-ramos@springfieldcityhall.com

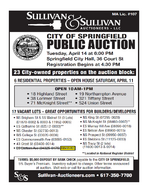

City of Springfield Announces Tax Title Auction of 23 Properties

Date: Tuesday, April 14, 2020

Time: 6:00PM

For more information, go to: sullivan-auctioneers.com

ALERT - PLEASE BE ADVISED ES EASTERN AVENUE (04325-0175) HAS BEEN REMOVED FROM THE AUCTION LIST

Funding Opportunities: Emergency Solutions Grant (ESG) and Housing Opportunities for Persons with AIDS (HOPWA) Programs

The City of Springfield Office of Housing has released two Requests for Proposals for the program year July 1, 2020 to June 30, 2021.

The ESG program provides funding for non-profit organizations to provide the following:

- Prevention/diversion for households at imminent risk of homelessness;

- Rapid rehousing services for homeless households;

- Outreach for the purpose of identifying chronically homeless individuals eligible for existing permanent supportive housing opportunities; and

- Operating support for established emergency shelter programs.

The HOPWA program provides funding for nonprofit organization to provide the following housing-related assistance to persons who are HIV positive:

- Housing information services;

- Rental assistance;

- Short-term rent, mortgage, and utility payments to prevent the homelessness; and

- Supportive services

RFP packages are available at the Springfield Office of Housing, 1600 E. Columbus Ave., Springfield, open M-F 8:30 am - 4:30 pm. You can also send an email to gmccafferty@springfieldcityhall.com to request an electronic version

Proposals are due to the Office of Housing Tuesday, March 3, 2020 by noon.

City of Springfield Announces Tax Title Auction of 26 Properties

Date: Thursday, November 7, 2019

Time: 6:00PM

For more information, go to: sullivan-auctioneers.com

ALERT - PLEASE BE ADVISED WS MILTON STREET (08710-0009) HAS BEEN REMOVED FROM THE AUCTION LIST

Copies of the Work Write Up and Specifications will be available at the following locations:

I. Office of Housing, beginning Monday, October 21, 2019 - Thursday, November 7, 2019. The Offie of Housing is open Monday-Friday from 8:30am-4:30pm and located at 1600 E Columbus Avenue, Springfield, MA 01103.

II. Property Open Houses held on Saturday, November 2, 2019 on site at the following locations and times.

PROPERTY ADDRESS | OPEN HOUSE |

21 Greenwich Street | 10:00am-12:00pm |

58 Itendale Street | 10:00am-12:00pm |

519 Union Street | 10:00am-12:00pm |

65 Maynard Street | 10:00am-12:00pm |

70 Amore Road | 1:00pm-3:00pm |

38 Lafayette Street | 1:00pm-3:00pm |

305 Rosewell Street | 1:00pm-3:00pm |

241 Main Street, IO | 1:00pm-3:00pm |

III. Auction Night - Property Specifications will be available for review at the auctioneer’s registration table on Auction night (Thursday, November 7, 2019)

Funding Opportunity: Springfield-Hampden County Continuum of Care

The Office of Housing has released a Request for Proposals (RFP) for the Springfield-Hampden County Continuum of Care (CoC) for the program year July 1, 2020 to June 30, 2021.

The CoC Program funds permanent supportive housing, rapid rehousing, joint transitional housing and rapid rehousing, and coordinated entry programs that assist people experiencing homelessness to become housed.

The RFP is available at the Office of Housing, 1600 E. Columbus Ave., Springfield, open M-F 8:15 am - 4:30 pm or send an email to gmccafferty@springfieldcityhall.com to request an electronic version.

Responses are due August 30, 2019 by 4 pm.

City of Springfield Announces Requests for Proposals (RFP) for the Purchase & Redevelopment of 74 Irvington Street w/ Development Incentive

The City is requesting proposals for the purchase and redevelopment of 74 Irvington Street (06975-0015) in the Forest Park neighborhood. This is a City owned property that consists of a 6,242 square foot lot that includes a 2 ½ story, vacant, residential property that is zoned Residence A. The City is most interested in proposals that will renovate 74 Irvington Street to an owner- occupied, single-family house. Renovations should incorporate restoration of historic elements and should be historically appropriate to the home and the surrounding neighborhood. The Forest Park neighborhood was designed as a Victorian garden district, developed between 1880 and 1920. The neighborhood begins one mile South of Springfield’s Metro Center and is the second largest City neighborhood. It contains 2,103 acres of land, 41% of which is conservation or parkland. The boundaries of the neighborhood are Mill River and Lake Massasoit to the north; Longmeadow, Massachusetts to the south; the Connecticut River to the west and the Highland Division Railroad to the east. To the west, 1-91 separates Forest Park from the Connecticut River. The neighborhood surrounds the 735-acre Frederick Law Olmstead designed Forest Park, for which the neighborhood is named. The City is providing a development incentive of up to $75,000 in U.S. Department of Housing and Urban Development Community Development Block Grant (CDBG) funds which will be available to qualified developers that demonstrate capacity to comply with the requirements of federal funding.

End date: Wednesday August 28, 2019 at 2 p.m.

Site Visit Schedule

The property will be open on the following dates and times for interested proposers to view:

• July 29, 2019 at 2:00 p.m.

• August 2, 2019 at 3:00 p.m.

• August 7, 2019 at 10:00 a.m.

• August 14, 2019 at 11:00 a.m.

Additional access may be requested and will be granted at the sole discretion of the City of Springfield by contacting Tina Quagliato Sullivan at 413-750-2114 or emailing tquagliato@springfieldcityhall.com

The Chief Procurement Officer may, in its sole and absolute discretion, reject any and all, or parts of any and all proposals; may re-advertise this RFP if so inclined; postpone or cancel at any time this RFP process; change, adjust, or modify the anticipated schedule of events.

Contact: Lauren Stabilo lstabilo@springfieldcityhall.com 413-787-6284

Request the complete specifications for this solicitation (20-014)

City of Springfield Announces Tax Title Auction of 20 Properties

Date: Tuesday, May 7, 2019

Time: 6:00PM

For more information, go to: sullivan-auctioneers.com

Click here to view Terms & Conditions of Sale

Click here to view Custodian's Notice of Sale

ALERT: Please be advised the property located at ES Pinecrest Drive has been removed from the Auction list.

IMPORTANT NOTICE!

- 321 TIFFANY STREET has been exposed to the elements for a significant amount of time and has what appears to be vermiculite insulation exposed in some areas. Please be advised, Vermiculite insulation may contain asbestos. CAUTION SHOULD BE EXERCISED BY ALL PARTIES WHO INTEND TO ENTER THIS STRUCTURE.

- 168 CENTRE STREET appears to have black mold present throughout the dwelling. CAUTION SHOULD BE EXERCISED BY ALL PARTIES WHO INTEND TO ENTER THIS STRUCTURE.

Copies of the Work Write Up and Specifications will be available at the following locations:

I. Office of Housing, beginning Tuesday, April 16, 2019 - Tuesday , May 7, 2019. The Offie of Housing is open Monday-Friday from 8:30am-4:30pm and located at 1600 E Columbus Avenue, Springfield, MA 01103.

II. Property Open Houses held on Saturday, May 4, 2019 on site at the following locations and times.

PROPERTY ADDRESS | OPEN HOUSE |

69 Woodmont | 9:00-11:00am |

125 Sherman Street | 9:00-11:00am |

321 Tiffany Street | 9:00-11:00am |

168 Centre Street | 12:00-2:00pm |

24 Welcome Place | 12:00-2:00pm |

26-28 Terrence Street | 12:00-2:00pm |

III. Auction Night - Property Specifications will be available for review at the auctioneer’s registration table on Auction night (Tuesday, May 7, 2019)

Funding Opportunity: City of Springfield Emergency Solutions Grant (ESG) Program

The City of Springfield Office of Housing has released its Request for Proposals (RFP) for the Emergency Solutions Grant (ESG) for the program year July 1, 2019 to June 30, 2020.

Springfield’s FY19 ESG priorities include:

- Prevention/diversion for households at imminent risk of homelessness;

- Rapid rehousing services for homeless households;

- Outreach for the purpose of identifying chronically homeless individuals eligible for existing permanent supportive housing opportunities;

- Operating support for established emergency shelter programs.

You can pick up the RFP at the Springfield Office of Housing, 1600 E. Columbus Ave., Springfield, open M-F 8:15 am - 4:30 pm or send an email to gmccafferty@springfieldcityhall.com to request an electronic version

Responses are due March 4, 2019 by noon.

City holds RFP Technical Assistance Workshop

Please click on the following link for a copy of the Power Point presentation for the City's Technical Assistance Workshop held on December 20, 2018. The workshop provided technical assistance on how to submit a successful RFP response to the City, including a review of Frequently Asked Questions and provide troubleshooting advice for potential respondents. It is good general information for anyone who may be interested in bidding on an RFP in the future.

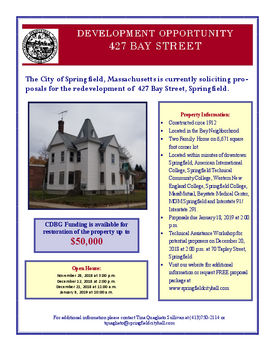

City issues Requests for Proposals (RFP) for Purchase and Redevelopment of 427 Bay Street & 74 Irvington Street

Request for Proposals for:

- Purchase & Redevelopment of 427 Bay Street per Bid# 19-073 (Click on Flyer above)

- Purchase & Redevelopment of 74 Irvington Street per Bid# 19-074 (Click on Flyer above)

RFPs will be received until 2:00P.M (EST) on: January 18, 2019 by Chief Procurement Officer, Lauren Stabilo at the Office of Procurement in City Hall, 36 Court Street, Room 307 Springfield, MA 01103.

Bid documents and specifications will be available at no charge beginning Wednesday, November 21, 2018 at 9:00am at the Office of Procurement or requesting a copy on the City’s website www.springfieldcityhall.com.

427 Bay Street – The City is requesting proposals for the purchase and redevelopment of 427 Bay Street (01085-0375) IN THE Bay neighborhood of Springfield, MA. This is a City owned property that consists of a 6,671 square foot lot that includes a 2 ½ story, vacant, residential property that is zoned Residence C. The property is on a corner lot where Cambridge and Bay Street meet, directly across from Oak Grove Cemetery. Assessed Value - $98,400

The property will be open on the following dates and times for interested proposers to view:

- November 28, 2018 at 3:00 p.m.

- December 12, 2018 at 2:00 p.m.

- December 21, 2018 at 11:00 a.m.

- January 8, 2019 at 10:00 a.m.

74 Irvington Street – The City is requesting proposals for the purchase and redevelopment of 74 Irvington Street (06975-0015) in the Forest Park neighborhood of Springfield, MA. This is a City owned property that consists of 6,242 square foot lot that includes a 2 ½ story, vacant, residential property that is zoned Residence A. The property is on a corner lot where Irvington Street, Trinity Terrace and Morningside Park meet. Assessed Value - $149,500

The property will be open on the following dates and times for interested proposers to view:

- November 28, 2018 at 2:00 p.m.

- December 12, 2018 at 3:00 p.m.

- December 21, 2018 at 10:00 a.m.

- January 8, 2019 at 11:00 a.m.

Additional access to the properties may be requested and will grated at the sole discretion of the City of Springfield by contacting Tina Quagliato Sullivan , Director of DRC at 413-750-2114 or emailing tquagliato@springfieldcityhall.com

Questions regarding the RFP should be submitted in writing to the Procurement Department. In order to provide prompt answers to questions, the City requests that all proposers submit written questions to the City of Springfield’s Procurement Department by January 11, 2019. Questions should be faxed, mailed or emailed to the following :

Mailing Address: Office of Procurement

Attn: Lauren Stabilo, Chief Procurement Officer

36 Court Street, Room 307

Springfield, MA 01103

Fax Number: (413) 787-6295

Email: lstabilo@springfieldcityhall.com

Technical Assistance Workshop

City of Springfield staff will be offering a pre-proposal technical assistance workshop on December 20th at 2:00 p.m. at 70 Tapley Street, Springfield. The workshop will provide technical assistance on how to submit a successful RFP response to the city. It will include a review of Frequently Asked Questions and will provide troubleshooting advice for potential respondents. It will include examples of successful responses and what RFP Review committee respondents look for when evaluating proposals. City staff will also do a brief overview of CDBG funding requirements and how funding is disbursed. All potential respondents are encouraged to attend.

The Chief Procurement Officer may, in its sole and absolute discretion, reject any and all, or parts of any and all proposals; may rea-advertise this RFP if so inclined; postpone or cancel at any time this RFP process; change, adjust, or modify the anticipated schedule of events.

News From the Office of Housing

Housing Study

The Office of Housing has completed a Housing Study for the Community Preservation Committee. The study provides a snapshot of Springfield’s housing conditions and market, along with a description of City programs and initiatives to address housing needs.

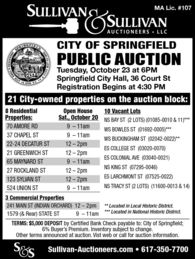

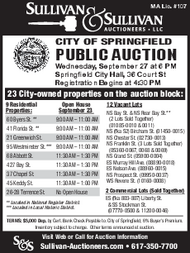

City of Springfield Announces Tax Title Auction of 21 Properties

Date: Tuesday, October 23, 2018

Time: 6:00PM

For more information, go to: sullivan-auctioneers.com

Click on the auction documents below to view:

Copies of the Work Write Up and Specifications will be available at the following locations:

I. Office of Housing, beginning Friday, September 27, 2018 – Tuesday, October 23, 2018. The Office of Housing is open Monday – Friday from 8:30am-4:30pm and located at 1600 East Columbus Avenue, Springfield, MA 01103.

II. Property Open Houses held on Saturday, October 20, 2018 on site at the following locations and times.

PROPERTY ADDRESS | OPEN HOUSE |

70 Amore Road | 9:00-11:00am |

37 Chapel Street | 9:00-11:00am |

65 Maynard Street | 9:00-11:00am |

524 Union Street | 9:00-11:00am |

1579 State Street | 9:00-11:00am |

22-24 Decatur Street | 12:00-2:00pm |

21 Greenwich Street | 12:00-2:00pm |

27 Rockland Street | 12:00-2:00pm |

123 Sylvan Street | 12:00-2:00pm |

241 Main Street, Indian Orchard | 12:00-2:00pm |

III. Auction Night - Property Specifications will be available for review at the auctioneer’s registration table on Auction night (Tuesday, October 23, 2018)

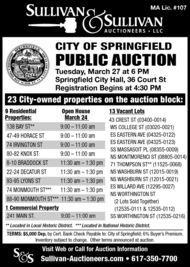

City of Springfield Announces Tax Title Auction of 23 Properties

Date: March 27, 2018

Time: 6:00 P.M.

For more information, go to: Sullivan-auctioneers.com

City of Springfield Announces Tax Title Auction of 23 Properties

Date: September 27, 2017

Time: 6:00pm

For more information, go to: Sullivan-auctioneers.com

Click here to view the Custodian's Notice of Sale

Click here to view Terms & Conditions of Sale

ALERT: Please be advised, 68 Abbott Street has been removed from the auction.

Springfield-Hampden County Continuum of Care has released its RFP for programs to include in its FY2017 CoC Competition Application

The Springfield-Hampden County CoC has released its Request for Proposals (RFP) seeking programs to include in its FY2017 CoC Competition Application.

The RFP seeks new, expansion, and renewal permanent supportive housing (PSH), Rapid Rehousing (RRH), and Joint Transitional Housing-Rapid Rehousing (TH-RRH) programs. The program funding period begins July 1, 2018.

The RFP and information posted about the opportunity are posted on the website of the Springfield-Hampden County CoC. Please click to visit the website for more information about this opportunity.

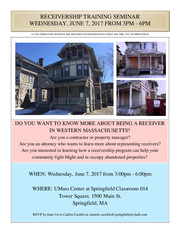

Receivership Training Seminar

City Launches Healthy Homes Program

The City of Springfield has launched a new Healthy Homes Program (HHP), which makes federal housing rehabilitation funds available to owners of 1-4 unit residential properties in the Memorial Square and Six Corners neighborhoods. The program is available for both owner-occupied and rental units. HHP provides funds for home rehabilitation, abatement of lead, removal of asthma triggers, and improvement of energy efficiency. It is an integrated, whole-house approach that produces sustainable, green, healthy and safe homes. Click here to view Press Release.

For more information on the Healthy Homes Program, click here to visit our page

Receivership Auction Notices

Receivership Auction Notices can now be viewed on the Receivership Auction Notices page under Neighborhood Revitalization. Please click on the link below to view notices of upcoming Receivership Auctions.

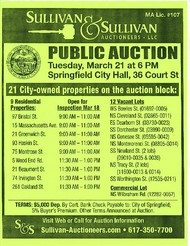

City of Springfield Announces Tax Title Auction of 21 Properties

Date: March 21, 2017

Time: 6:00pm

Click here to view the Terms & Conditions of Sale

Click here to view the Custodian's Notice of Sale

For more information, go to: Sullivan-auctioneers.com

ALERT - Please be advised, 74 Irvington Street has been removed from the auction list

ALERT - Please be advised, the pre-auction inspection scheduled for 21 Greenwich Street has been canceled.

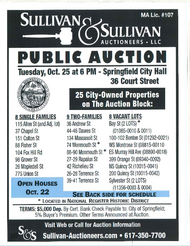

City of Springfield Announces Tax Title Auction of 25 Properties

Springfield-Hampden County Continuum of Care seeks new and renewal housing programs

The Springfield-Hampden Continuum of Care has released the FY16 Request for the Proposals for New and Renewal CoC Projects.

The CoC will hold a bidders conference on Wednesday, July 27, 2016 at 10a.m. at the City of Springfield Office of Housing, 1600 E. Columbus Ave., Springfield. Completed applications are due by August 12, 2016 at 4:00p.m. Please see the RFP for complete instructions.

Springfield-Hampden County Continuum of Care seeks new sponsor for existing housing program

The Springfield-Hampden Continuum of Care has issued an RFP for New Project Sponsor for Permanent Supportive Housing for Chronically Homeless Families. The RFP seeks a new operator for an existing project that provides permanent supportive housing to eight families who have been chronically homeless.

There will be a bidders conference on Wednesday, July 27, 2016 at 11a.m. Applications are due August 5, 2016 at 4p.m., at the Springfield Office of Housing, 1600 E. Columbus Avenue, Springfield. Please see the RFP for additional information about this funding opportunity.

City of Springfield Announces Tax Title Auction of 25 Properties

Click here to view the Terms & Conditions of Sale

Click here to view the Custodian's Notice of Sale

ALERT: Please be advised the property located at 46 Wellesley Street has been removed from the Auction list.

ALERT: Please be advised the property located at NS Orange Street (09340-0015) has been removed from the Auction list.

City of Springfield Announces Tax Title Auction of 23 Properties

Click here to view the Terms & Conditions of Sale

Click here to view the Custodian's Notice of Sale

ALERT: Please be advised 15 Massachusetts has been removed from the auction list.

City Seeks Entity to Operate Existing Family Permanent Supportive Housing Program

The City of Springfield is soliciting proposals for a nonprofit, government or housing authority organization to operate an existing scattered site project that provides permanent supportive housing to eight families who were previously chronically homeless.

A bidders' conference will take place October 8, 2015 at 1pm at the Office of Housing, 1600 E. Columbus Ave., and applications must be submitted by October 20, 2015 at 4pm. For more information, please review the Request for Proposals.

Springfield/Hampden County Continuum of Care (CoC) Soliciting Proposals for Projects to Provide Assessment and Housing for Homeless Persons

The Springfield/Hampden County Continuum of Care (CoC) is soliciting proposals for projects to provide assessment and housing for homeless persons. Selected projects will be included in the CoC's collaborative grant application which will be submitted to the US Department of Housing and Urban Development in November 2015.

A bidders' conference will take place October 8, 2015 at 2pm at the Office of Housing, 1600 E. Columbus Ave,. and applications must be submitted by October 20, 2015 at 4pm. For more information, please review the Request for Proposals.

City of Springfield Announces Tax Title Auction of 24 Properties

Receivership Auction Notices

Receivership Auction Notices can now be viewed on the Receivership Auction Notices Page. Please click on the link below to view notices of upcoming Receivership Auctions:

City Soliciting Proposals for the Redevelopment of 803-807 Liberty Street

The City is soliciting proposals for the redevelopment of 803-807 Liberty Street. The building at 803-807 Liberty Street is a brick, mixed-use building constructed in 1916. The building contains approximately 12,906 square feet of living/commercial space and is located on a 5,000 square foot lot and is zoned Business A. The property has four floors and contains approximately nine residential units and two commercial units on the ground floor. The property is being sold "as is" with the adjacent lot at SS Stockman Street (11200-0046).

A site tour is scheduled for June 18th at 2:00 p.m. Proposals are due to the Office of Procurement, City Hall, 36 Court Street, Room 307 no later than July 9, 2014 at 2:00 p.m.

Copies of the RFP may be obtained by emailing lstabilo@springfieldcityhall.com

Click here to view the article from The Republican/Masslive

City Schedules Tax Title Auction of 25 Properties

The City of Springfield has scheduled a ballroom style auction of twenty-five tax foreclosed properties for June 17, 2014 at 6:00 p.m. (registration begins at 5:00 p.m.) at the Good Life Center, 1600 East Columbus Avenue.

For additional information you may visit our website or the Posnik Auctioneers' website.

Housing Court Now Accepting New Receivership Applications

The Western Division Housing Court is now accepting applications for the List of Qualified Receivers. Applications are available at the Clerk's Office at the Housing Court.

To be considered for the list, applications must be submitted to the Clerk's Office by July 31, 2014. Completed applications should be mailed to:

Western Housing Court

Attn: Clerk Magistrate Peter Montori/Receiver Application

37 Elm Street, P.O. Box 559

Springfield, MA 01102.

If you are currently on the Court's list, please note that your application needs to be renewed annually!

City issues Requests for Proposals (RFP) for Purchase and Redevelopment of 174 Maple Street & 176 Maple Street

The City of Springfield is soliciting proposals for the purchase and redevelopment of two, tax foreclosed, Victorian row-houses at 174 Maple Street and 176 Maple Street.

Open houses will be held at 174 & 176 Maple Street during the following times:

- Thursday, April 24, 2014 at 3:00 p.m.

- Tuesday, April 29, 2014 at 11:00 a.m.

Proposals must be received by Friday, May 16 at 2:00 p.m. by the Office of Procurement, City Hall , 36 Court Street, Room 307. Interested purchasers may request copies of the RFP by emailing lstabilo@springfieldcityhall.com

The City is interested in proposals which will renovate these historic row house to their appearance in 1939 and as approved by the Springfield Historical Commission. The City is most interested in proposals which will renovate both buildings as single-family and/or two-family homes. The City will consider proposals for a three-family house or four-family house for 174 Maple Street and will consider proposals up to three-family for 176 Maple Street. Proposals resulting in lower densities are preferred. Proposals resulting in owner-occupied units, including condominiums, are preferred. Nonresidential uses will only be considered as accessory uses to residential uses. Institutional uses such as group homes, churches, and schools will not be allowed.

These properties are located in the Maple Hill Local Historic District, which is both a certified local historic district and listed on the State Register Historic Places. Income producing projects may qualify for the federal and state 20% tax credit for historic rehabilitation.

CDBG funds are being made available by the City to be used for exterior repairs. No income restrictions are applied to these funds. CDBG funds will be an interest free, forgivable loan not to exceed $100,000. A total of $200,000 for exterior repairs to both properties is available. Proposals that minimize the use of public funds are preferred. The loan will be paid out as reimbursement of expenditures. Half of the loan will be forgiven upon issuance of a Certificate of Occupancy by the Springfield Building Commissioner. Once the Certificate of Occupancy has been obtained, 20% of the remaining loan will be forgiven each year the property is maintained in compliance with code enforcement over the next five year period.

The proposed development should minimize other public expenditures and not require ongoing public operating subsidies.

City Issues RFP for Emergency Solutions Grant (ESG) Program

Springfield has been allocated $305,439 in federal Emergency Solutions Grant (ESG) funds for FY14. These funds are to be used for homelessness prevention and rapid rehousing, and to provide some support for existing emergency shelters.

The City has released a Request for Proposals (RFP) seeking providers to operate ESG programs. Applications for program funds are due May 12, 2014, by 2:00 pm, at the Office of Housing, 1600 East Columbus Avenue, Springfield, MA 01103.

For more information, view the RFP:

All updates to the RFP will be posted here for public viewing.

City of Springfield Issues Notice of Funding Availability and Request for Proposals for Disaster Recovery Area

The City of Springfield has been awarded $21.8 million dollars in Community Development Block Grant – Disaster Recovery (CDBG-DR) funds as a result of multiple presidentially declared disasters occurring in 2011. As a result of this funding the City of Springfield is making $1.4 million dollars available in CDBG-DR funds for proposals for developers for “ready to proceed” single-family, new construction projects that will provide homeownership opportunities to low-moderate income buyers who are within 120% of Area Median Income.

Basic Eligibility Requirements:

The City is seeking projects within a limited area of the Old Hill/Six Corners neighborhoods that was heavily impacted by the June 1, 2011 tornado. The City is most interested in proposals that will create high quality, newly constructed single family homes on each proposed site. The City will entertain proposals that include a second unit, but additional units will not be considered as advantageous as single family proposals. Proposal s should include home re-sale to income qualified buyers within 120% of Area Median Income (AMI). Developers must be able to demonstrate a successful track record in housing development and utilizing comparable federal funds and regulations, ability to comply with CDBG-DR requirements and must site control for all proposed projects. Projects should be ready to proceed immediately and all new construction and expenditure of funds must be completed no later than September 2015.

Proposals will be received until April 22, 2014 at 2:00 p.m. by the Office of Procurement, City Hall, 36 Court Street, Room 307, Springfield, MA

To obtain more details and/or a copy of the Request for Proposal/Notice of Funding Availability please email lstabilo@springfieldcityhall.com.

City Schedules Tax Title Auction of 26 Properties

The City of Springfield has scheduled a ballroom style auction of 26 tax foreclosed properties for March 25th, 2014 at 6:00 pm (Registration begins at 5:00 pm) at the Good Life Center, 1600 East Columbus Avenue.

For additional information you may visit our website or the Posnik Auctioneers website.

City Selling Multiple Vacant Parcels

The City is soliciting proposals for the purchase and redevlopment of the following vacant lots:

- NS Melrose Street (08520-0012)

- SS Melrose Street (08520-0025)

- NS Marshall Street (08305-0007)

- ES Pine Street (09715-0124)

The properties are located throughout the Maple-High/Six Corners neighborhood and the Old Hill neighborhood. Both areas were heavily affected by the June 1, 2011 tornado and this Request for Proposals (RFP) is an important piece of the rebuilding process. The City is most interested in proposals that create newly constructed, single family homes on each of these lots. The City is seeking high quality home design plans that are in character with the existing neighborhood.

The City is making available a maximum of $800,000 in Community Development Block Grant - Disaster Recovery funds towards the redevelopment of the properties included in this RFP.

Proposals will be accepted until April 9, 2014 at 2:00 pm by the Office of Procurement, City Hall, 36 Court Street, Room 307.

For additional information you may visit the Office of Procurement website. Click here to view the article by The Republican/Masslive.

City Selling Apartment Building at 169 Maple Street

The City of Springfield is soliciting proposals for the purchase and redevelopment of the multi-unit building at 169 Maple Street. The property is located within the Ridgewood Local Historic District in the Maple-High/Six Corners neighborhood of Springfield.

The building is a brick, residential apartment building constructed in 1920, it contains 30,522 square feet and is located on a 7,454 square foot lot and is zoned Commercial A. The assessed value is $390,300. The property has five levels and contains approximately ten, spacious, three bedroom units. Five of these units are currently occupied.

Site tours are being conducted on March 12, 2014 at 2:00pm and March 19, 2014 at 10:00am.

Proposals are being accepted until April 9, 2014 at 2:00 pm, by the Office of Procurement, City Hall, 36 Court Street, Room 307.

For additional information please visit the Office of Procurement website. To view the article from The Republican/Masslive please click here.

City Seeks Bids for the Demolition of the Former Chestnut Street School

The City of Springfield through its' Office of Housing is soliciting bids from contractors for the demolition and removal of demolition debris of the former Chestnut Street School site at 495 Chestnut Street. Bids are due by Wednesday, February 19, 2014 at 2:00 p.m. to the Office of Procurement, City Hall, 36 Court Street, Springfield.

A mandatory pre-bid conference and site tour is scheduled for February 11, 2014 at 10 a.m.

Contact Tina Quagliato at (413)787-6500 / tquagliato@springfieldcityhall.com for additional information.

Click here to view bid information from the Office of Procurement.

City Receives Bids Totaling $631,000 at Tax Title Auction of 24 Properties

The City of Springfield auctioned 24 tax foreclosed properties on Wednesday, December 11, 2013 and received bids totaling $631,000. The auction was conducted at City Hall by Aaron Posnik & Co., Auctioneers. The highest bid received was for a commercial property at 1130 Bay Street.

City Seeks Bids for the Demolition/Deconstruction of Abandoned Building at 2612-2616 Main Street & Arch Street

The City of Springfield through its' Office of Housing is soliciting bids from contractors for the demolition/deconstruction of the condemned building at 2612-2616 Main Street & 3 Arch Street. Bids are due by Wednesday, December 18, 2013 at 2:00 p.m. to the Office of Procurement, City Hall, 36 Court Street, Springfield.

The site will be open on December 9, 2013 between the hours of 10 a.m. -2 p.m. Contact Tina Quagliato at (413)787-6500 / tquagliato@springfieldcityhall.com for additional information.

Click here to view the article from The Republican/Masslive.

Click here for bid information from the Office of Procurement.

City Schedules Tax Title Auction

The City has scheduled a Municipal Auction for twenty-five (25) tax foreclosed properties. The ballroom-style auction will take place on December 11, 2013 at 6:00 p.m. at City Hall, 36 Court Street, Springfield. For additional information please contact the City's private auctioneer Aaron Posnik Auctioneers/Appraisers at (413)733-5238. To view the article from The Republican/Masslive.com please click here.

City Hosts Receivership Training

On October 23, 2013 the City of Springfield, in conjunction with the Western Division Housing Court, held a receivership training for current and potential receivers and their attorneys.

Presentations were given by the following:

- The Honorable Dina E. Fein, First Justice, Western Division Housing Court

- Assistant Clerk Magistrate Michael Doherty, Western Division Housing Court

- Associate City Solicitor Lisa deSousa, City of Springfield - Law Department

- Geraldine McCafferty, Director, City of Springfield - Office of Housing

- Attorney Katharine Higgins-Shea, Lyon & Fitzpatrick

- Attorney Patti Glenn, Springfield

- Tony Witman, Witman Properties

- Attorney Christopher Johnson, Johnson, Sclafani & Moriarity

- Rita Farrell, Massachusetts Housing Partnership

- Attorney Kurt McHugh, Harmon Law Offices, Newton

The training was attended by over 50 people including staff from the City of Springfield, City of Holyoke, Western Division Housing Court, Attorney General Martha Coakley's Office, in addition to many current and prospective receivers.

Click here for additional information on receivership and the training materials.

City Awaits HUD Approval of Analysis of Impediments to Fair Housing

In May and June 2013, the City took written comments and held hearings on its Draft Analysis of Impediments to Fair Housing. The City has incorporated those comments into a new document, which has been submitted to HUD and awaits final approval.

Click to view the Analysis of Impediments to Fair Housing that was submitted to HUD.

City Schedules Tax Title Auction for Tuesday, June 18, 2013

The City of Springfield in partnership with Daniel J. Flynn & Co., will be auctioning eighteen (18) tax foreclosed properties on Tuesday, June 18, 2013. Registration begins at 5:00 PM and the auciton will begin at 6:00 PM. The ballroom style auction will take place at City Hall, 36 Court Street, 2nd Floor.

Open Houses will be conducted on Sunday, June 9th, 2013 at the various properties. For a schedule please visit the auctioneer's website http://www.flynnauctions.com/.

Those who intend to register as bidders should come prepared with a $5,000 bank and/or certified check per property.

You may view additional auction information on our website or view the Auction Flyer.

City Releases DRAFT 2nd Neighborhood Stabilization Program 3 (NSP3) Substantial Amendment

The City has released a DRAFT 2nd Neighborhood Stabilization Program 3 (NSP3) Substantial Amendment for public comment. The 2nd Substantial Amendment changes the initial Substantial Amendment by re-allocating $50,000 from homeownership to rental housing targeted to persons with incomes at or below 50% area median income. These funds will be used for rehabilitation of the multi-family property at 71 Adams St.

The 2nd Substantial Amendment is available here.

Please submit written comments by June 21, 2013 to Geraldine McCafferty at gmccafferty@springfieldcityhall.com or at the Office of Housing, 1600 E. Columbus Ave., Springfield, MA 01103.

City Seeks Input on Analysis of Impediments to Fair Housing

The City is updating it Analysis of Impediments to Fair Housing, and seeks your input. Click here to see the DRAFT Analysis.

To comment on the draft, please send written comments by June 11 to gmccafferty@springfieldcityhall.com or attend a public hearing on the draft Analysis. The hearing will take place June 11, 5 pm, in Room 220, Springfield City Hall.

City launches new "Abutter Lot Sale Program"

The "Abutter Lot Sale Program" is designed to sell City-owned, vacant lots, valued under $25,000 to property owners with a home, building and/or property directly abutting a vacant lot. Abutters would be able to purchase approved lots directly from the City without going through a public disposition process such as a Request for Proposal (RFP) or auction.

The program will be administered through the Office of Housing will require an application to be made. Please note that if a property is City owned the Office of Housing will investigate whether or not the lot will be eligible for sale through this program. Click here for an application and/or additional information.

Massachusetts Department of Housing and Community Development - Tornado Response Home Rehabilitation Program

Eligible Communities: Agawam, Brimfield, Monson, Southbridge, Springfield, Sturbridge, Westfield, West Springfield and Wilbraham.

Eligible Households: Homeowners from the nine eligible communities whose primary residences were damaged by the June 1, 2011 tornado and who require additional financial assistance to supplement other public, private and non-profit sources and/or to address needs not met by other funding sources.

Eligible Uses: Tornado Response HR Funds may be used for work items or repairs which are not or only partially funded through insurance or other public or donated funding. This may include such things as demolition of detached outbuildings, historic rehabilitation, removal of trees that presenting an obstacle to residents, water damage, mitigation of mold and water damage, and standard building repair such as roofs, windows, siding, etc.

In addition, these funds may be used to supplement other funding towards rebuilding homes completely destroyed or the purchase and installation of a mobile home or modular home to replace a home that was destroyed in the June 1, 2011 tornado.

All work funded through this program must be performed by qualified and licensed contractors. Under certain circumstances, "sweat equity" through a self-help agreement will be allowed if it can be demonstrated that 1)the owner is capable of performing the work or 2)the effort is being undertaken in conjunction with coordinated volunteers and will leverage additional monies to the project. In these circumstances, an itemized materials cost estimate must be provided accompanied by a quote from the suppliers.

Prioritization of Assistance: Requests for assistance will be categorized according to need. Priority 1 Assistance is for those households who need additional funding to complete work which allow them to get back into their home. Priority 2 Assistance is for households who need additional funding to eliminate a health or safety issue within the primary residence. Priority 3 Assistance is for households who need additional funding to eliminate a health or safety issue on the property of the primary residence. Priority 4 Assistance is for all other eligible tornado related requests.

Income Restrictions: At least 75% of these funds must benefit households whose gross income does not exceed 80% of the area median income (AMI). Up to 25% of these funds can be used to benefit households whose gross income is between 80% and 100% of the AMI.

Assistance Limitations: The value of repairs or improvements made to any individual residence using these funds cannot exceed $7,500 unless an unusual circumstance requires a larger expenditure. In these cases a waiver for up to a total of $15,000 may be sought with the additional funds limited to ensuring the home is made safe and secure. Waiver amounts and availability will be influenced by household income levels.

Application: Please contact Laurel Foley-Beauchesne, Pioneer Valley Planning Commission, 60 Congress Street, Springfield, MA 01104 at (413)781-6045 or be email at lfoley-beauchesne@pvpc.org.

DevelopSpringfield to Host Informational Session with the Massachusetts Division of Insurance

DevelopSpringfield is pleased to host representatives of the Massachusetts Department of Insurance on May 31st from 4 PM – 8 PM at the Federal Room in the STCC Technology Park, 1 Federal St, Springfield, MA 01105.

Commissioner of Insurance Joseph G. Murphy has asked members of his team in the Department of Insurance to meet with residents of Springfield and the immediate area, who were impacted by the June 1, 2011 tornado, and who continue to have questions or concerns about their insurance coverage. The Department of Insurance team will meet with residents one-on-one to answer questions and to provide general guidance.

This session will be free and open to the public. If you have questions, please contact DevelopSpringfield at (413) 209-8808.

Notice to Current and Prospective Court Appointed Receivers

One June 1st, 2012 the Western Division Housing Court's list of qualified receivers for cases involving violations of the State Sanitary Code will be dissolved and reconstituted.

If you want your name to be included on the new receiver list when this transition takes place, you must submit an application by April 1, 2012. Afterwards, applications will be accepted on a rolling basis.

Applications are available at the Clerk's Office at the Western Division Housing Court, 37 Elm Street, Springfield, MA 01102.

Rebuild Springfield - District Meetings Scheduled

Next week, Rebuild Springfield will be holding the final round of public district meetings. This will be the public's last time to provide input and commentary on the district plans before the Citywide strategy is completed. These meetings will be held at the following locations:

- DISTRICT #1 - METRO CENTER & SOUTH END: Thursday, December 15, 2011 from 6:30 - 9:00 p.m. @ the South End Middle School (36 Margaret Street)

- DISTRICT #2 - SIX CORNERS, OLD HILL, UPPER HILL & FOREST PARK: Wednesday, December 14, 2011 from 6:30 p.m. - 9:00 p.m. @ J.C. Williams Community Center (116 Florence Street)

- DISTRICT #3 - SIXTEEN ACRES & EAST FOREST PARK: Tuesday, December 13, 2011 from 6:30 p.m. - 9:00 p.m. @ Greenleaf Community Center (1188 Parker Street)

For updates and more information, view the flyer or visit the Rebuild Springfield website.

Tax Title Auction Brings in $324,709

The City of Springfield held a successful auction of tax foreclosed properties on Wednesday, November 30.

Homeowner Rebuilding Guide

The City of Springfield and HAPHousing have teamed up to create a Rebuilding Guide for Homeowners to assist residents in accessing and identifying the resources they need to rebuild after the devastating tornado on June 1, 2011. This Guide has been generously supported by Develop Springfield.

The guide provides detailed information about insurance, FEMA assistance and SBA loans, undertaking construction and working with City agencies, and incentives and information for green building, healthy homes, handicap accessibility and historic preservation. The Guide also tells you where to go for assistance if you need help navigating the system.

Community Rebuilding Fair

As individuals and communities are striving to rebuild homes, businesses and lives in the aftermath of the tornado that touched down on June 1, there continues to be many unanswered questions about the recovery process. Many others who were not directly affected by the tornado also have questions and needs. At the Community Rebuilding Fair, attendees will have the opportunity to learn about available programs and have direct access to services.

Participants can meet with legal, insurance, financial, housing, zoning, career, construction, and sustainability experts to ask questions and obtain assistance. This community event is open to the public and is FREE.

The Community Rebuilding Fair will take place on Wednesday, September 28, 2011 at the High School of Commerce, 415 State Street, Springfield. Between 4:00 p.m. - 8:00 p.m.

Financial Fitness Education

Springfield Neighborhood Housing Services provides Financial Fitness education for clients who are not ready to purchase for various reasons such as: credit issues, bankruptcy or high debts. The Financial Fitness program identifies the obstacles that prevent people from buying, helps them develop a plan and budget, and monitors the customer’s progress towards overcoming the obstacles. The workshops are ten hours of intensive education covering topics including:

- Credit Issues

- Getting and Staying Out of Debt

- Managing Your Money

- Beginning a Banking Relationship

- Creating Wealth for You and Your Family

- Predatory Lending Tactics to Avoid

Workshop Schedule:

All workshops run for four weeks, two hours and 30 minutes each week for a total of ten hours and are held from 6:00 to 8:30 p.m. at 111 Wilbraham Road, Springfield (unless otherwise stated).

September, 2011

- Date: Wednesdays, September 7th, 14th, 21st, and 28th

Location: 721 State Street, Springfield, MA

October, 2011

- Dates: Mondays, October 10th, 17th, 24th and 31st

Location: Springfield NHS - 111 Wilbraham Road, Springfield, MA

November, 2011

- Date: Wednesdays, November 2nd, 9th, 16th and 23rd

Location: Springfield NHS - 111 Wilbraham Rd, Springfield, MA.

December, 2011

- Date: Mondays, December 5th, 12th, 19th and 26th

Location: Springfield NHS - 111 Wilbraham Rd, Springfield, MA.